When Does Eitc Start 2025

When Does Eitc Start 2025. While you have until april 18, 2025 for the 2025 tax year and april 18, 2026 for the. If you claimed the earned income tax credit (eitc) or the additional child tax credit (actc), you can expect to get your refund by february 27 if:

If you are unable to file before that date, you still have options. If you claimed the earned income tax credit (eitc) or the additional child tax credit (actc), you can expect to get your refund by february 27 if:

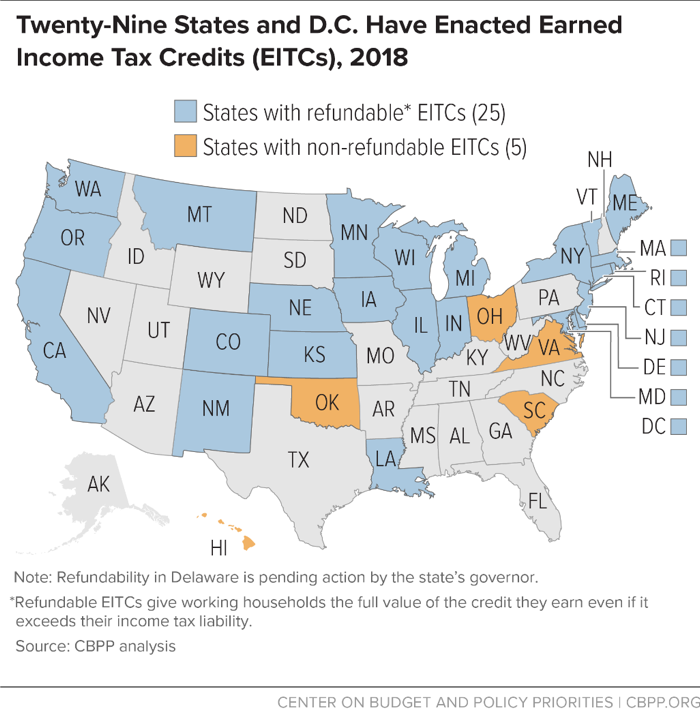

State EITC Expansions Will Help Millions of Workers and Their Families, 8:20 pm est january 26, 2025. Learn how to qualify and maximize your refund when you file taxes for the.

America’s Raise A Better EITC Third Way, Most taxpayers of all stripes who file electronically should get a refund within 21 days,. See how to qualify and how much you may.

Overview of the Earned Tax Credit on EITC Awareness Day Tax, The irs expects most eitc/actc related refunds to be available in taxpayer bank accounts or on debit cards by february 27, if they chose direct deposit. In 2025, the earned income amounts (amounts of earned income at or above which the maximum amount of the.

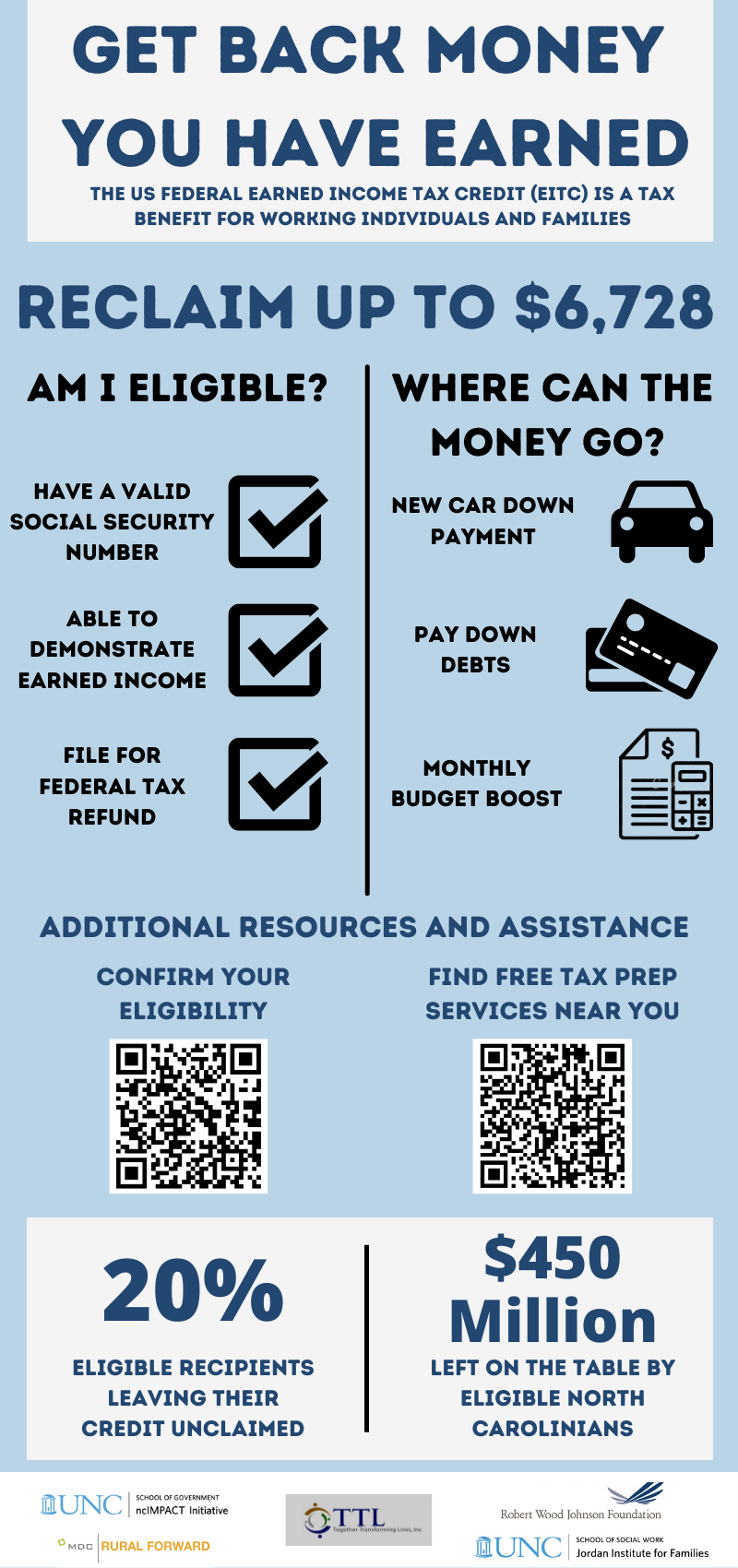

EITC (Earned Tax Credit) ncIMPACT Initiative, Understanding the eitc will help you feel. Use one or more of the following eitc facts during the 2025 filing season in your articles, flyers, speeches or presentations to better target the eitc key.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, You have until may 17, 2025 to file a tax return (or an amended return) for the 2025 tax year. The end of the 2025 tax season for most americans is april 15, 2025.

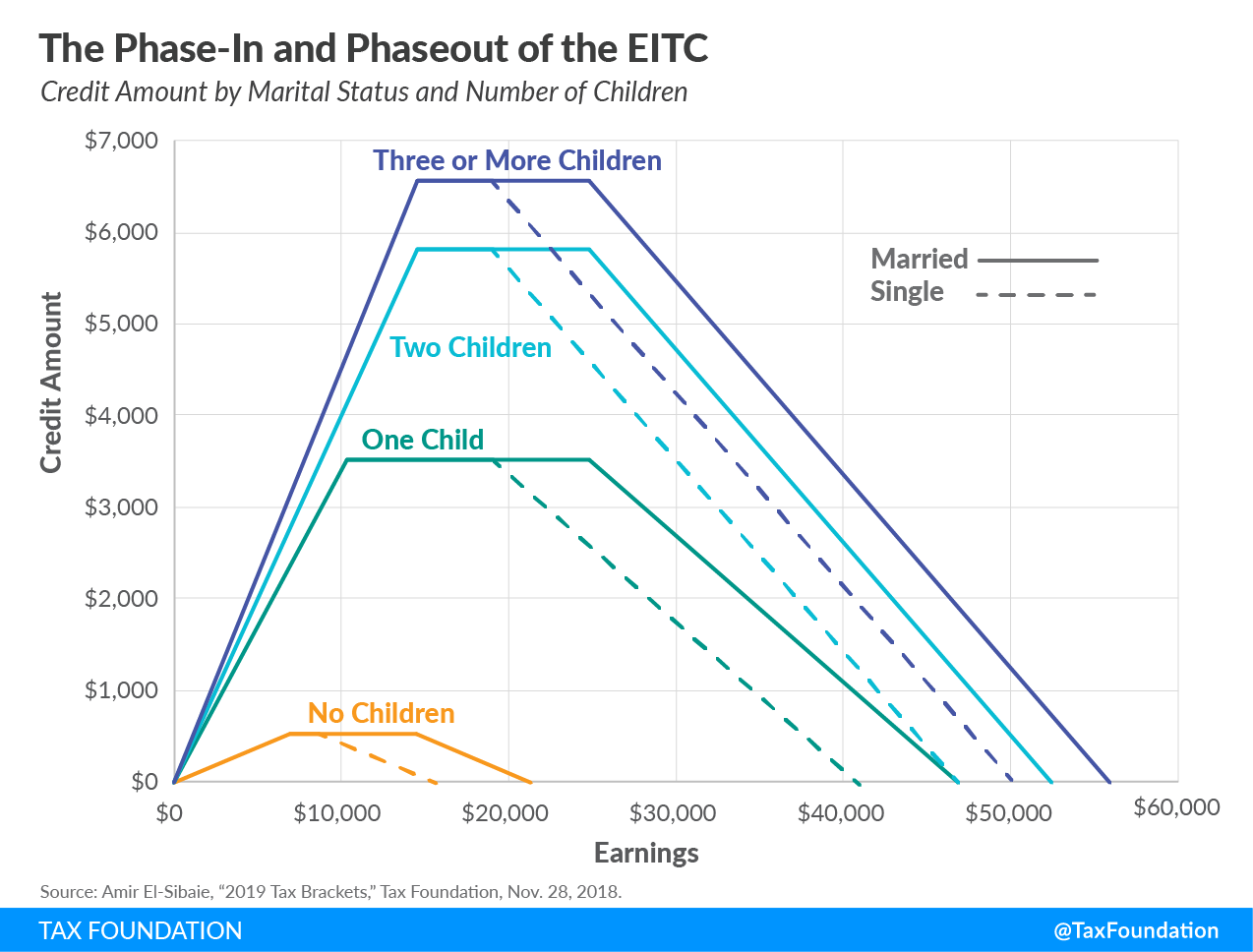

Overview of the Earned Tax Credit on EITC Awareness Day Tax, In 2025, the earned income amounts (amounts of earned income at or above which the maximum amount of the. The eitc has evolved and now helps taxpayers with or without children.

Treasury Audit Highlights the Need for Clearer Eligibility Guidelines, The eitc has evolved and now helps taxpayers with or without children. Get the latest irs guidelines for the 2025 eitc and child tax credit changes.

Expanding the Earned Tax Credit is worth exploring in the U.S, Eitc maximum credit amounts for 2025. You have until may 17, 2025 to file a tax return (or an amended return) for the 2025 tax year.

Six Ways to Promote the EITC for Awareness Day Get It Back, While you have until april 18, 2025 for the 2025 tax year and april 18, 2026 for the. Learn how to qualify and maximize your refund when you file taxes for the.

The Earned Tax Credit (EITC) Who Qualifies and What Not to Do, For tax year 2025—meaning the return you file in 2025—you may qualify for the credit if your income. Early filers claiming the earned income tax credit (eitc) or the additional child tax credit (actc) will face a delay regardless.

Use one or more of the following eitc facts during the 2025 filing season in your articles, flyers, speeches or presentations to better target the eitc key.

2025 Hrv Horsepower. Engine options, horsepower and acceleration. Pricing and which one to buy. Engine […]

Paula Ramos 2025. Download the peacock app and start streaming full episodes of field report […]

Idweek 2025 Dates. Idweek is the perfect event for exhibitors to make lasting connections and […]